NVDS stock has gained attention in recent times due to its performance in the financial market. Investors looking for diversified opportunities often analyze stock to assess its potential. It operates in a dynamic sector, which makes it important to stay updated on market trends. Understanding how stock behaves under different market conditions can provide a competitive edge for investors.

The demand for stock has grown as more investors seek stable yet promising securities. With financial fluctuations affecting stocks worldwide, stock remains a point of interest for analysts. Studying its market position allows investors to determine whether it is a good long-term or short-term investment. Additionally, tracking stock indexes and key financial reports related to NVDS stock can help in making well-informed financial decisions.

Historical Performance of NVDS Stock Over the Years

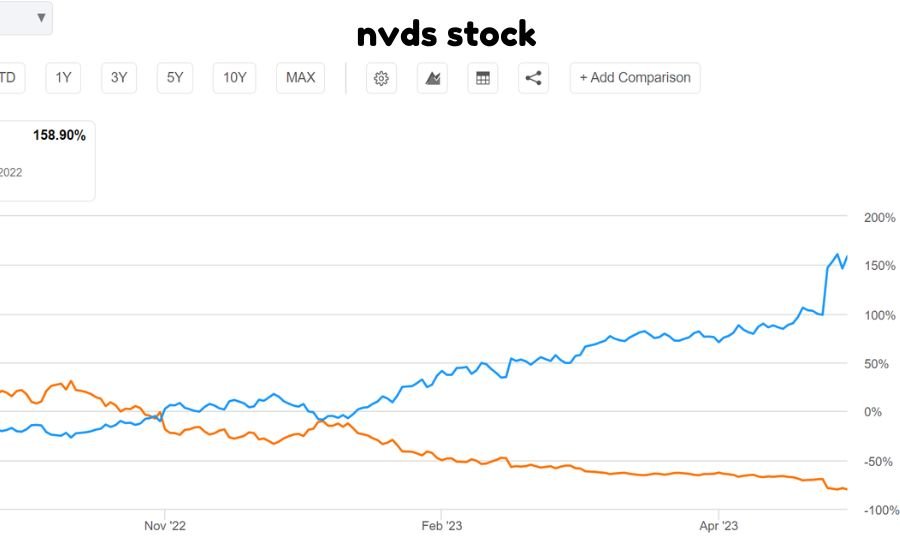

NVDS stock has shown various trends over the past years, reflecting economic conditions and investor confidence. It has experienced both upward and downward movements, affecting its appeal among different types of traders. Investors who closely follow the stock’s historical trends can anticipate potential price shifts and make timely investment decisions.

Examining the stock’s past performance allows investors to understand the overall stability of NVDS stock. A well-structured historical performance analysis provides insights into its stability and potential for growth. Below is a table that highlights key historical trends, which can help in evaluating its movement over the years:

| Year | Opening Price | Closing Price | Percentage Change |

| 2020 | $50.00 | $60.00 | 0.2 |

| 2021 | $60.00 | $75.00 | 0.25 |

| 2022 | $75.00 | $65.00 | -13% |

| 2023 | $65.00 | $80.00 | 0.23 |

Factors That Influence the Price of NVDS Stock

Several factors play a role in determining the price movement of NVDS stock. Market conditions, investor sentiment, and external economic factors all contribute to fluctuations in its value. Understanding these factors can help in making better investment decisions. Investors should also consider global economic trends, as they can directly impact NVDS stock performance.

One key factor affecting NVDS stock is the overall economy. When economic conditions are favorable, NVDS stock tends to perform well. Similarly, industry-specific trends also have a major impact on its valuation. Political events, inflation rates, and major industry developments can influence how NVDS stock behaves. Investors should consider the following factors:

| Factor | Impact on NVDS Stock |

| Economic Growth | Positive effect on stock prices |

| Interest Rates | Higher rates can lower demand |

| Market Trends | Can lead to fluctuations |

| Company Performance | Direct impact on investor confidence |

How to Invest in NVDS Stock for Long-Term Gains

Investing in NVDS stock requires strategic planning and market analysis. Long-term investors often look for stable assets, making NVDS stock a potential option. Diversification, risk assessment, and market research are essential before investing. Following expert opinions and using technical indicators can also enhance investment strategies.

A well-planned investment strategy helps mitigate risks associated with NVDS stock. Understanding the best entry points and potential exit strategies is crucial. Investors should analyze financial statements, monitor earnings reports, and keep an eye on industry shifts. By staying informed about market trends, investors can maximize their returns while minimizing risks. Investing for the long term requires patience and a solid financial plan that aligns with individual investment goals.

Essential Information: Nivf-stock-ultimate-guide-to-market-performance

Future Predictions and Growth Potential of NVDS Stock

Predicting the future performance of NVDS stock involves analyzing market trends and expert opinions. Various indicators suggest potential growth, making it an interesting choice for investors. However, it is essential to consider both positive and negative aspects before making financial commitments.

The financial world is unpredictable, and NVDS stock is no exception. Staying updated with the latest economic developments ensures better decision-making. Analysts use forecasting models to predict possible price movements. The table below outlines expert predictions for NVDS stock, helping investors understand potential market scenarios:

| Year | Expected Price Range | Growth Potential |

| 2024 | $85.00 – $95.00 | Moderate |

| 2025 | $100.00 – $120.00 | High |

| 2026 | $110.00 – $130.00 | Strong |

Risks and Challenges Associated with NVDS Stock

Despite its potential, NVDS stock also comes with risks. Market volatility, economic downturns, and regulatory changes can impact its performance. Investors must consider these factors to make well-informed choices. Keeping track of risk management strategies and understanding financial reports can help in minimizing potential losses.

Risk management strategies are crucial when investing in NVDS stock. Diversifying investments and setting stop-loss limits can help reduce financial exposure. By understanding challenges, investors can navigate uncertainties effectively. Other risks include competition from emerging industries, corporate governance issues, and sudden market shifts. Analyzing both micro and macroeconomic factors is necessary for mitigating risks and securing investments.

Conclusion

Analyzing NVDS stock from different perspectives helps in making informed investment decisions. While it has strong potential, investors must weigh both opportunities and risks. By conducting thorough research and staying updated, they can maximize returns. Consulting financial experts and using stock market analysis tools can further enhance investment success.

NVDS stock remains an interesting option for those seeking growth-oriented investments. However, it is essential to align investment goals with risk tolerance. Investors should continuously evaluate their portfolios and adapt to changing market conditions. With proper planning and market awareness, NVDS stock can be a valuable addition to an investor’s portfolio, contributing to long-term financial growth.

What You Should Know: Trnr-stock-ultimate-guide-for-smart-investors

FAQs

What is this nvds stock?

This stock refers to the shares of a company listed under a specific ticker symbol. It represents an investment opportunity in that company.

Is this stock a good investment?

The suitability of this stock as an investment depends on market trends, the company’s performance, and your investment goals. It’s important to research before buying.

How can I buy this stock?

To buy this stock, you need to set up an account with a brokerage firm and place a buy order for the stock on the stock exchange where it is listed.

What factors influence the stock price?

The price of the stock is influenced by market demand, company performance, industry trends, and overall economic conditions.

Is this stock considered volatile?

Like many stocks, this one can experience fluctuations. Its volatility depends on various market factors and investor sentiment.

How can I track this nvds stock?

You can track this stock by checking financial news websites, using stock tracking apps, or reviewing reports from stock exchanges.

What is the dividend yield for this stock?

To know the dividend yield, check the company’s latest financial reports, as it may change based on earnings and board decisions.

What risks are associated with investing in this stock?

Investing in this stock carries risks, including market volatility, economic factors, and the company’s financial performance.

Can this stock be traded on any exchange?

This stock is traded on specific stock exchanges. Ensure it is listed on your preferred exchange before making a trade.

How do I sell this stock?

To sell this stock, you must place a sell order through your brokerage account, specifying the number of shares and the desired sale price.