Investing in stocks requires research, patience, and strategy. NIVF stock has gained attention among investors due to its market movements and potential for growth. Understanding its financial aspects, trends, and investment opportunities is essential for making informed decisions. The stock market is highly dynamic, and knowing how NIVF stock fits within this landscape can help investors maximize their returns and minimize risks. Thorough research and continuous monitoring are key factors for successful investment strategies.

Investors often look for stocks with strong fundamentals, stable financials, and promising growth potential. stock appears to be an attractive choice for many, given its consistent performance and market adaptability. Studying how it has performed over the years can help investors determine if it is a suitable addition to their portfolios. By evaluating past trends, future predictions, and overall financial health, investors can make more confident decisions about investing in NIVF stock.

What is NIVF Stock?

NIVF stock represents shares in a company that operates in a competitive industry. Investors seek information about its price trends, company performance, and future projections before making investment decisions. Studying its historical data helps in analyzing its stability and long-term potential.

It is crucial to understand the business model, revenue streams, and growth plans of the company behind NIVF stock to ensure a sound investment. Investors also look at aspects like the management team, innovation potential, and market positioning to determine whether the stock is a viable option for their portfolio.

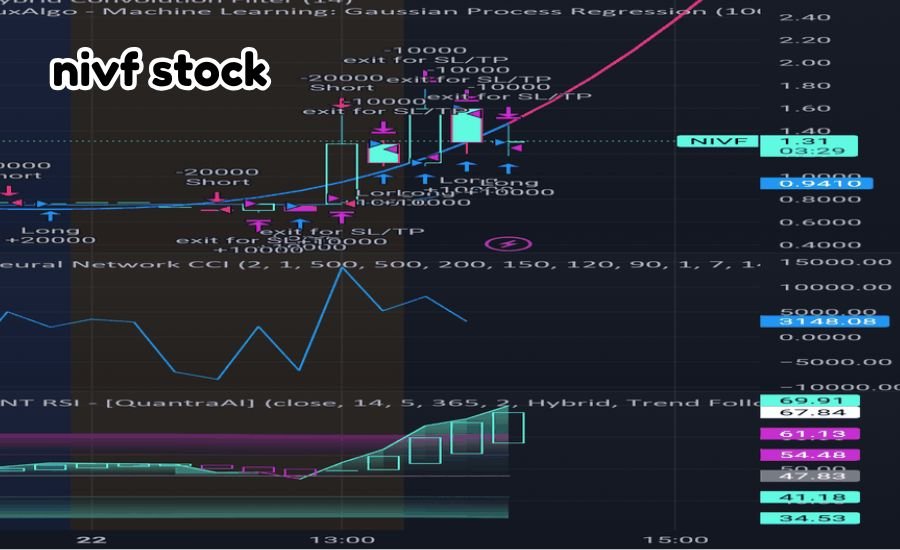

Market Trends of NIVF Stock

Stock market trends determine how an investment performs over time. NIVF stock experiences fluctuations based on economic conditions, market demand, and investor sentiment. Comparing past and present data allows investors to predict future trends.

A stock’s performance is affected by various external factors such as inflation rates, interest rates, global economic policies, and industry-specific developments. Keeping an eye on these influencing elements can provide investors with a clearer picture of where NIVF stock is headed and how they should approach their investment strategy.

| Year | Opening Price | Closing Price | Highest Price | Lowest Price |

| 2021 | $50.20 | $55.80 | $60.00 | $48.50 |

| 2022 | $56.10 | $59.70 | $65.40 | $52.30 |

| 2023 | $60.00 | $62.50 | $68.90 | $55.80 |

Why Investors Consider NIVF Stock?

Investors choose NIVF stock for its potential returns and stable market presence. Some key reasons include:

- Consistent Growth: Its financial statements indicate steady revenue growth. A company that shows consistent earnings and revenue growth over multiple years is more attractive to long-term investors.

- Industry Reputation: A strong market reputation attracts investors. Companies with well-established brand value and a history of strong performance are likely to sustain growth over time.

- Investment Diversification: A good addition to a diversified portfolio. Adding NIVF stock to an investment portfolio can help spread risk and balance potential losses with gains from other stocks.

Financial Analysis of NIVF Stock

Understanding financial ratios helps investors assess stock performance. NIVF stock showcases strong financials, making it a preferred choice for investment. Financial metrics such as earnings per share (EPS), return on investment (ROI), and profit margins are crucial for evaluating a stock’s potential. Examining a company’s financial health through its balance sheet, income statement, and cash flow statement provides deeper insights into its overall stability and growth trajectory.

| Financial Metric | Value |

| Price-to-Earnings Ratio | 18.2 |

| Dividend Yield | 2.50% |

| Return on Equity | 15.60% |

| Debt-to-Equity Ratio | 0.75 |

Future Predictions for NIVF Stock

Market analysts provide future projections based on company performance and economic conditions. NIVF stock is expected to show steady growth, with positive earnings forecasts. Predicting stock performance requires analyzing past data, market trends, and economic indicators. Analysts often use forecasting models and valuation methods to project where the stock might be in the coming years. While no forecast is entirely accurate, informed predictions can help investors make better choices.

Long-term investors often look for strong fundamentals in a stock before committing their funds. If NIVF stock continues its positive trajectory, it may attract more investors seeking stable and promising returns. By staying updated on company reports, earnings releases, and global economic trends, investors can make more precise and strategic investment decisions regarding NIVF stock.

You May Also Like: Game_msstore_ship-exe-error-bo6-ultimate-guide-to-fixing-and-preventing-issues

Risks Involved in Investing in NIVF Stock

Every stock carries risks, and NIVF stock is no exception. Some risks include:

- Market Volatility: Prices may fluctuate due to economic factors. Stock markets are inherently volatile, and external events such as political instability, global crises, or unexpected economic downturns can lead to rapid price changes.

- Company Performance: Revenue and profit affect stock prices. If the company fails to meet revenue or earnings expectations, its stock price can drop significantly, leading to investor losses.

- Regulatory Changes: Government policies impact investments. Changes in tax laws, compliance regulations, or industry-specific policies can affect stock performance and overall investor sentiment.

How to Invest in NIVF Stock?

Investing in NIVF stock requires a step-by-step approach:

- Research: Analyze past trends and market performance. Understanding the company’s financials, industry outlook, and competitive landscape is crucial for making a sound investment decision.

- Choose a Broker: Open an account with a reliable stockbroker. Working with a trusted brokerage platform ensures seamless trading and access to valuable market insights.

- Monitor Performance: Keep track of price movements and company updates. Staying informed about industry developments and quarterly earnings reports helps in making timely investment decisions.

Conclusion

Investing in NIVF stock can be a profitable decision for investors who conduct proper research. Understanding market trends, financial data, and risks ensures better investment strategies. Whether you are a beginner or an experienced investor, evaluating all factors will help in making informed choices. Keeping a diversified portfolio, staying updated on stock market news, and practicing disciplined investing can lead to long-term financial success. NIVF stock has shown promising potential, and with the right approach, investors can maximize their gains while mitigating risks.

A well-planned investment in NIVF stock can lead to stable returns if investors stay vigilant and adapt to market conditions. With proper risk management strategies and continuous monitoring, investors can confidently navigate the stock market. While no investment is without risk, thorough research and patience can help investors capitalize on opportunities and achieve financial growth through NIVF stock.

Get The Latest Updates On: Trnr-stock-ultimate-guide-for-smart-investors

FAQs

What does this stock represent?

It represents shares of a company that investors can buy and sell in the stock market.

Is this stock a good investment?

It has shown stable growth, but like any investment, it carries risks that should be evaluated.

How can I purchase shares?

You can buy shares through a stockbroker or an online trading platform after conducting proper research.

What factors influence its price?

Market demand, company performance, economic conditions, and global events impact its value.

Does it offer dividends?

It depends on the company’s financial strategy. Investors should check the latest reports for updates.

What are the risks involved?

Market volatility, company financial performance, and regulatory changes can affect its value.

How often should I monitor it?

Regular monitoring is recommended, especially during earnings reports and market fluctuations.

Is it suitable for beginners?

Yes, but beginners should research thoroughly and consider seeking financial advice before investing.

What are the future predictions?

Analysts predict stable growth, but external factors can influence performance.

How can I reduce investment risks?

Diversifying your portfolio, staying updated on market trends, and investing wisely can help reduce risk.